This is the 5th and final blog in the Fall 2018 Life After Loss blog series:

Grief & Money Go Together Like Flies & Honey

In other words, they don’t.

Unfortunately, they do tend to dance into our lives, hand in hand, at the same time…like some sort of poorly-matched dynamic duo.

On some deeper level, we may perceive the money we receive as the result of a loved one’s death as blood money. Click To TweetAnd because of this, much to our dismay we may find ourselves giving it away – in one form or another – as fast as possible.

But believe me, this is rarely intentional.

So what’s going on?

“If you come into big money when you’re not ready for it on the inside, the chances are your wealth will be short-lived and you will lose it.”

– T. Harv Eker

Why?

Because, as one of my all-time favourite authors explains:

“It’s hard to hold on to what we don’t believe we deserve, whether it’s money, love, or success.”

– Sarah Ban Breathnach

But why, for Heaven’s sake, wouldn’t we believe we “deserve” the money?

Because if a sizeable chunk of money has come our way as the result of the sudden (or not so sudden) death of a loved one, we may feel guilt. Click To TweetEven if we had absolutely nothing to do in bringing about the death of our loved one, we may still experience guilt…although we may not be consciously aware of it.

But WHY would we feel guilty?

Because we are still here…alive and hopefully healthy (although probably not very happy) and yet our loved one’s life is over. It’s called survivor’s guilt and although it is not rational, it is very real. Thankfully, it doesn’t have to last long – if diagnosed. The problem, of course, is that it often isn’t diagnosed.

The fallout of survivor’s guilt manifests – often for years to come – in our choices, our lives, our actions, our habits, our relationships and oh yes, our bank account. Click To TweetWhether we like it or not, our ability to make prudent financial decisions in the wake of a significant loss is often hampered by the fact that we may be spending money in an attempt to make ourselves feel better. We might be trying to fill the void in our lives – and the Grand Canyon-sized hole in our hearts – with stuff.

Does it work? In the short term, sort of. In the long term, no.

The temporary high that comes with spending does not – cannot – fill the emotional and spiritual void in our hearts and lives…although it can certainly fill our homes and closets with copious amounts of clutter and crap. Click To TweetAs with the drug addict needing the next high, the hit that comes with buying something soon subsides and the quickest way to get that quasi-good feeling again is to spend.

I strongly suspect that when we are in the depths of grief, we also spend to feel some semblance of control. If our loved one has been oh-so-unfairly yanked from us, we learn a very brutal life lesson about just how little control we have. And I think it is human nature to not take particularly kindly to this realization. So to compensate, we may choose to go shopping and buy whatever the heck we want…because we can. We may not be able to financially afford this activity but in the short term, the sense of power it temporarily gives us seems worth the long-term ramifications.

But real power – authentic power – doesn’t come from buying things. It can’t. Authentic power has to do with our souls and our purpose for being here. Yes, money plays a significant role in us fulfilling our purpose…but the soul’s currency is not cash. It is love and service, kindness and compassion.

The next time you go to purchase something, ask yourself: what is you are really trying to buy?

Finally – but perhaps most importantly when it comes to the dynamic duo of grief & money – the reality is that we may be shocked to discover that the death of a loved one has caused a hurt that is, unbelievably, far worse than we ever could have imagined.

This passage from the book, Lady Chatterley’s Lover by D.H. Lawrence, captures beautifully what I suspect may be going on below the surface in the wake of experiencing an incredibly painful loss:

“And dimly she realized one of the great laws of the human soul: that when the emotional soul receives a wounding shock, which does not kill the body, the soul seems to recover as the body recovers. But this is only appearance…Slowly, slowly the wound to the soul begins to make itself felt, like a bruise, which only slowly deepens its terrible ache, till it fills all the psyche. And when we think we have recovered and forgotten, it is then that the terrible after-effects have to be encountered at their worst.”

In other words: even though some time may have passed since our loss, the horrific hurt we have experienced – the wounding of our soul – may be just starting to make its way to the surface. Choose wisely how you handle that hurt. Spending and/or giving away more money than you can afford will, in the long run, cause more harm than good.

Money is sacred. Money is freedom. But with freedom comes responsibility.

“If you expect your money to take care of you, you must take care of your money.”

– Suze Orman

If you suspect that I speak so passionately on this subject matter because of personal experience, you’d be right. I have learned the hard way that spending money one cannot afford to spend – whether that’s buying stuff, donating to charity, gift-giving, trying to make the world a better place through funding financially unsustainable projects, and so on – does not bring a loved one back. It does not make people love you more. It does not right a wrong.

What it does do is put you in a financially precarious position that can jeopardize your future and rob you of the freedom to forge a new path of your choosing.

If you have experienced the loss of a loved one and are struggling with how to make prudent financial decisions, my wish for you this coming year is to get the professional guidance you need to get back on track…your track to a financially sustainable future.

Will I be blogging more about grief & money in the future?

You can bet your bottom dollar I will. If you want to receive these blogs, be sure to subscribe to the Life After Loss blog series.

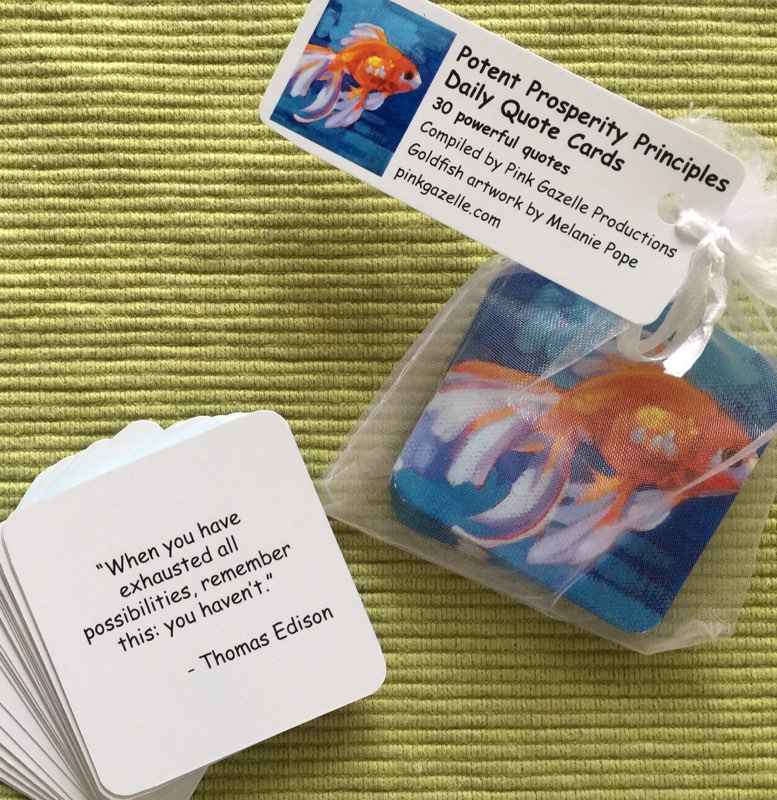

In the meantime, you may find our “Potent Prosperity Principles” quote cards (30 per set) of help. Available in our Etsy store.

Maryanne Pope is the author of A Widow’s Awakening, the playwright of Saviour and the screenwriter of God’s Country. Maryanne is CEO of Pink Gazelle Productions and Chair of the John Petropoulos Memorial Fund. If you would like to receive her regular weekly blog, please sign up here.

2 thoughts on “Grief & Money”

This message came in from a reader via e-mail:

I learned a lot from your latest Life After Loss blog on money & grief. Excellent piece!

I can totally see how one WOULD just start giving away money after the wrongful death of a loved one. The whole “blood money” image has some serious power.

Honestly, even with my mom’s money, which isn’t blood money at all, just her hard earned money that she slaved over her job as a nurse for years!! Well..I’ve been doling it out to charities left and right.

Once Christmas is past, maybe I need to NOT do that!?! Maybe I will save some of it for some of my daughter’s education – for which my mom was her BIGGEST supporter. Your blog really got me thinking…

Oh…now isn’t THAT interesting about how you are handling your Mom’s money?! SO glad my blog got you thinking. Writing the damn thing – which I have put off doing for years – has sure got ME thinking, as well! Especially around this time of year when we tend to give gifts because of cultural & societal pressure & traditions.

Maryanne